If you’ve been involved in global trade, even peripherally, you know that relying on predictable shipping container costs has been as reliable as predicting the weather in a hurricane. Over the past decade, and particularly since 2020, the market for container shipping has been anything but stable.

What’s behind these dramatic shifts, and how can businesses stay agile in a world of constant flux? Let’s cut through the noise and look at the forces at play, drawing lessons from recent history to prepare for the unpredictable future.

Because, as the sources show, expecting the unexpected is the only constant.

The Pre-Pandemic Calm of Shipping Container Costs

The Pre-Pandemic Calm of Shipping Container Costs

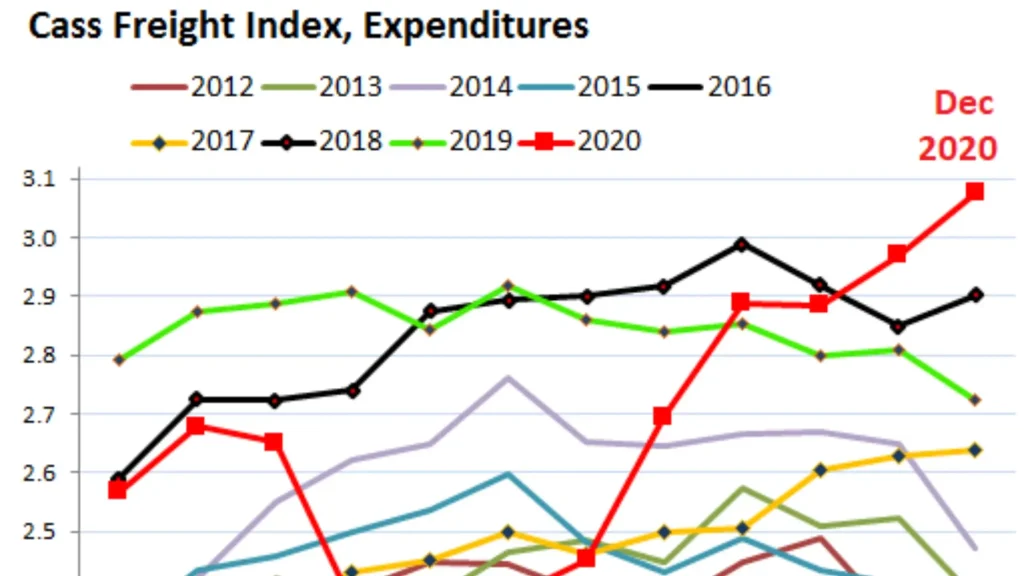

While the provided sources primarily focus on the tumultuous period from 2020 onwards, it’s understood that the years leading up to the COVID-19 pandemic saw more relative stability in shipping container costs. This period of relative calm stands in stark contrast to the turbulence that has characterized the shipping industry in recent times.

Seasonal and Cyclical Trends

Even before the pandemic, the global trade landscape was subject to economic cycles and seasonal variations. These factors often sparked minor, yet easily manageable shifts in container rates, leading to smoother and more gradual price adjustments as time progressed.

COVID-19: The Shockwave That Rewrote the Rules (2020–2022)

The Plunge and Surge of Global Shipping Container Prices

The global landscape shifted dramatically, and with it, the cost of shipping containers skyrocketed. The COVID-19 pandemic unleashed an unparalleled disruption on worldwide supply networks, forever altering the flow of goods across the globe.

At the outset, sweeping lockdowns and stringent restrictions triggered an abrupt collapse in consumer demand, as daily life ground to a halt and purchasing priorities dramatically shifted. As a result, shipping rates experienced a brief downturn, offering temporary relief before broader market forces regained control.

Demand Surge and Congested Ports

This was the false calm before the storm. As economies began to reopen, a massive surge in demand for consumer goods overwhelmed the system.

Key ports such as Los Angeles, Shanghai, and Rotterdam became bottlenecks, facing overwhelming congestion that stalled the movement of goods across critical trade routes. Ships were stuck waiting to unload, creating bottlenecks across the network.

Container Imbalance and Soaring Costs

Intensifying the crisis was a severe imbalance in container availability, as empty boxes piled up in the wrong places, deepening the global supply chain turmoil. Containers were in the wrong places, stuck on delayed ships, or piled up at congested ports.

This imbalance meant fewer containers were available to load new goods. The result was skyrocketing shipping rates and increased volatility.

Prolonged Disruptions into 2022

Disruptions continued into 2022. New COVID variants, shifting consumer demand, and ongoing logistics challenges further strained the system.

Rates spiked during peak seasons. Companies scrambled to restock inventories under pressure.

A Wake-Up Call for Global Trade

This period vividly demonstrated how global events can swiftly upend shipping container costs. The lesson: disruption can arrive quickly and affect businesses of all sizes.

Geopolitics and Economic Headwinds (2023–2024)

Trade Wars and Global Tensions

Just as the pandemic pressures began to ease, new global forces entered the picture. Geopolitical tensions began to significantly influence shipping container prices.

Trade tensions between the US and China led to route shifts and cost increases. Tariffs and trade restrictions reshaped shipping volumes and altered established transportation routes.

Sanctions and Route Disruptions

Sanctions related to the Russia-Ukraine conflict disrupted logistics. Routes were altered, and insurance costs rose, pushing up overall freight rates.

Inflation and Fuel Price Impacts Shipping Container Costs

Simultaneously, global economic recovery introduced new dynamics. Soaring inflation placed a double burden on both everyday consumers and logistics companies. The surge in fuel prices sharply raised carriers’ operating costs, which were ultimately shifted onto consumers through elevated shipping fees.

Sustained Shipping Container Rate Pressure

Even as demand surged again, port and capacity pressures persisted. Shipping container costs remained elevated, especially during peak periods.

The Red Sea Crisis: Rerouting the World's Trade Lanes (Late 2023–2024)

Attacks and Avoiding the Suez Canal

Then came another major disruption to global trade: the Red Sea crisis. Beginning in late 2023, attacks by Houthi rebels on vessels forced dramatic route changes.

Carriers began avoiding the Suez Canal. As a result, ships changed their course, opting to bypass the Cape of Good Hope.

Longer Routes and Higher Costs

This alternative route added considerable time and cost. Extended voyages consumed significantly more fuel and kept vessels occupied for longer durations, effectively reducing overall shipping availability and straining global logistics networks.

As a result, freight rates soared in some areas by as much as 186%. By the end of 2024, ocean freight rates on disrupted trade lanes had surged to more than twice their previous levels, reflecting the mounting pressure on an already strained maritime industry.

Slow Return and Strategic Adjustments

Some carriers have cautiously returned to the Suez Canal. The broader situation continues to be unpredictable and precarious.

Peak seasons arrived early due to these disruptions. Shippers adjusted schedules in anticipation of longer transit times.

Looking Ahead: Tariffs, Alliances, and Uncertainty of Shipping Container Costs in 2025

Slow Return and Strategic Adjustments

As we move through 2025, volatility continues. New and increased tariffs on US imports are adding more complexity.

Tariff announcements target a broad range of goods. The combined effect of tariffs could push costs up by more than 70% on certain Chinese goods.

E-Commerce Hit by Policy Changes

The removal of the de minimis exemption for sub-$800 shipments from China adds cost. E-commerce businesses are especially affected.

Alliance Reshuffling and Rate Volatility

Red Sea diversions still influence shipping costs. While some ships return, disruptions persist.

Carrier alliance restructuring is another variable. Such alterations lead to fluctuations in available capacity, pricing structures, and the duration of transit, disrupting the flow of goods across supply chains.

Mixed Shipping Container Costs Market Signals

Some regions see downward price pressure from added competition. Others face steep proposed rate increases.

At the start of 2025, global shipping rates saw a modest decline, largely driven by the seasonal lull that followed the holiday surge in demand. Yet they remain well above 2019 levels.

Carriers are managing capacity cautiously. But the success of planned General Rate Increases (GRIs) is still uncertain.

Technology and Regulation: Shaping the Future Landscape

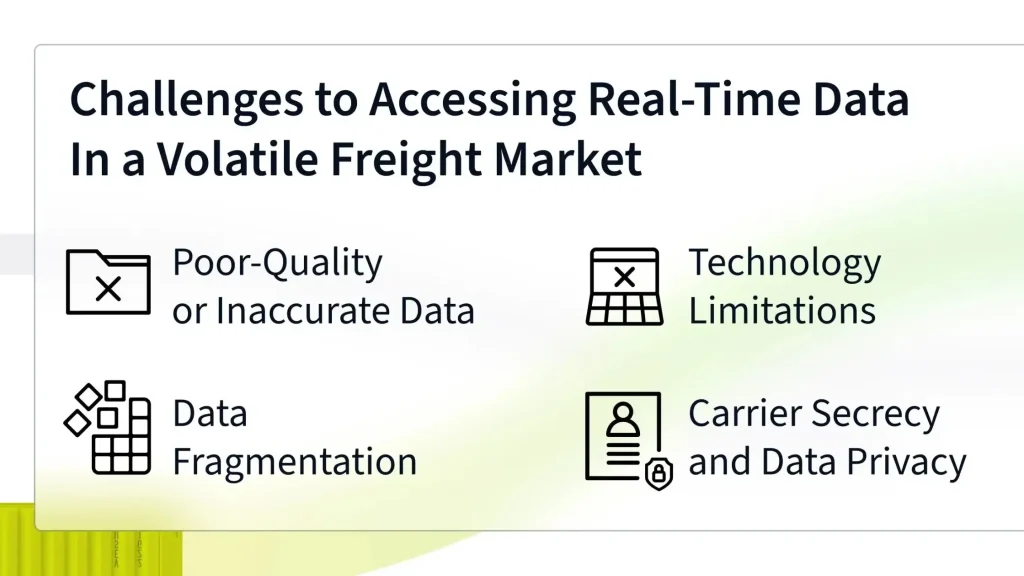

Efficiency Through Digitalization

Two quieter forces are also shaping container costs: technology and regulation. These trends may bring longer-term changes.

Smart shipping containers are improving transparency and operational efficiency. This helps reduce delays and optimize container use.

Green Shipping and IMO Rules

Sustainability efforts are gaining traction. Investments in LNG-powered vessels and electric port equipment are on the rise.

Emerging environmental regulations from the International Maritime Organization (IMO) are also reshaping the economics of container shipping, nudging costs upward as carriers adapt to greener, compliance-driven operations. IMO 2024 requires lower sulfur emissions, driving investment in cleaner tech.

These investments raise short-term expenses. But they promise greater long-term stability and cost control.

Real-Time Reality: Shippers Adapt to Volatility

Frontloading and Spot Market Surges

Businesses are adjusting to this new reality. Real-time awareness and agility have become key. Spot ocean freight rates surged in early 2024. Many interpreted this as an early arrival of peak season.

Shippers began frontloading imports to avoid delays later. This approach prioritizes timely delivery over inventory minimization.

Contract Risks and Rolling Cargo

More volume entered the spot market as a result. Naturally, this pushed rates higher.

Long-term contract rates remained relatively flat. Carriers were eager to lock in volume despite rising spot prices.

But low contract rates bring risk. Freight may be rescheduled or deferred to prioritize more lucrative spot market opportunities.

This fear factor is now a real part of supply chain planning. It influences decisions even when capacity is available.

Black Swan Events on the Horizon

Other risks loom, including Panama Canal restrictions, US-China tensions, and possible labor strikes. Each has the potential to disrupt global flow.

Businesses are building inventories to hedge against such risks. Shippers must now balance the expense of warehousing against the reliability of getting goods safely to their destination.

Strategies for Navigating Turbulent Shipping Container Costs

Diversify and Compare Freight Prices

There’s no one-size-fits-all strategy in today’s market. Businesses must understand their supply chains deeply.

Compare shipping container quotes and transport modes. Ocean freight offers savings at the cost of speed, while air transport trades higher expense for rapid delivery.

Build Buffers and Stay Flexible

Build buffers into budgets and timelines. Unexpected charges and shipment hold-ups have become a frequent part of today’s logistics landscape.

Consider warehousing to stabilize inventory flow. This helps avoid last-minute shipping at premium rates.

Build Buffers and Stay Flexible

Be mindful when using freight platforms like Freightos. Delays and extra charges can happen due to third-party issues.

Book early when the goods are ready. This increases the likelihood that your shipment stays on schedule and ahead of delays. Communicate regularly with your freight forwarder. They’re a key source of updates and risk insights.

Monitor market trends using rate indexes and shipping bulletins. Staying informed helps businesses respond faster.

Conclusion

Over the last ten years, the world of international shipping containers has undergone a profound transformation, reshaping how goods move across borders. The last five years, in particular, brought dramatic and ongoing volatility.

From the shockwaves of the pandemic to the turmoil in the Red Sea, supply chain chaos has shifted from anomaly to expectation. New tariffs and shifting alliances in 2025 only add to the complexity.

Stability may not return anytime soon. The best strategy is to build real-time responsiveness into supply chains.

Use data. Stay flexible. Communicate often.

On-Site Storage Solutions

In today’s volatile shipping world, finding reliable and cost-effective solutions for your storage and shipping needs is more critical than ever. At On-Site Storage Solutions, we’re your trusted partner in navigating these unpredictable trends.

As North America and Canada’s highest-rated supplier of shipping containers, we understand the complexities businesses face with fluctuating shipping container costs and supply chain disruptions.

Our containers are not only top-tier in durability and security, but they are also weather-resistant, ensuring that your goods remain safe and protected, no matter what.

With an A+ rating from the Better Business Bureau, we pride ourselves on delivering unparalleled service and quality every time. If you need storage for goods in transit or long-term storage solutions, we offer flexible rental and rent-to-own options, with quick delivery times tailored to your unique needs.

Call On-Site Storage Solutions today at (888) 977-9085 to get your container delivered right to your doorstep. Let us provide you with a seamless, dependable solution for all your shipping and storage needs.