The shipping container demand landscape is poised for a dramatic shift following the latest U.S.–China trade agreement.

After months of uncertainty caused by 145% tariffs and escalating trade tensions, businesses are now gearing up for a surge in orders that could put unprecedented pressure on global supply chains.

A Demand Shock Like No Other

“Shipping container demand” is back in the headlines, and not in the way most expected.

As business owners and manufacturers scramble to restore depleted inventories, analysts warn that a rush of simultaneous orders could overwhelm ports, carriers, and last-mile delivery networks.

This kind of sudden spike is what experts call a “demand shock.”

Jason Miller, supply chain management professor at Michigan State University, explained to Axios, “The manufacturers are not going to just magically be able to meet that demand.”

Shipping Container Demand and Just-In-Time Inventory

Just-in-time inventory systems, once the standard for lean operations, are now a vulnerability.

Businesses operating on razor-thin stock levels face greater exposure to disruptions.

The sudden spike in shipping container demand underscores the need to rethink these models.

Tracking Demand for Shipping Containers Across Sectors

The effects aren’t uniform across industries.

Retail, automotive, and electronics are seeing the sharpest spikes.

Meanwhile, construction materials and food imports are also trending upward due to their seasonal sensitivity.

Understanding how shipping container demand varies by sector is key to forecasting and planning.

How Global Policies Influence Shipping Container Demand

Trade policy decisions directly impact the velocity and volume of international shipping containers.

Even the perception of stability can trigger waves of new orders.

The latest deal, compared to pre-pandemic, has already shifted sentiment, causing an immediate uptick in container bookings.

How We Got Here: The Collapse Before the Comeback

In early April, the U.S. imposed steep 145% tariffs on Chinese goods.

The result? Trade activity between the two countries plummeted.

At the Port of Los Angeles—America’s busiest entry point—containers piled up empty while sailings were canceled en masse.

Double-digit drops in shipping volumes were reported for weeks.

As one executive noted, “Money is fungible, supply chains are not.”

You can reallocate your cruise budget toward a new hot tub, but you can’t turn cruise ships into hot tub delivery vehicles.

The Freight Recession’s Lingering Effects on Shipping Container Demand

Before the trade truce, freight haulers were already reeling.

Three years of freight recession left truckers and logistics companies cash-strapped.

Now, with the potential for a spike in container shipping rates, trucking rates are likely to follow.

While this sounds like relief, the sudden resurgence might be too late for some businesses hanging by a thread.

A few trucking companies may go under before the rebound even hits.

What This Means for Ports, Carriers, and Shipping Container Demand

The new deal is a green light, but the race is already congested.

Ports such as Long Beach and Oakland are bracing for the increasing demand of large vessels and cargo ships.

And with the cost of ocean freight having plummeted from its 2023 peak, there’s a narrow window before rates rebound.

Expect congestion, delays, and even missed opportunities.

Shipping container demand in the United States will spike not just for restocking purposes but as a hedge against future disruptions.

Supply Chains Are Fragile by Design

The pandemic taught us that global trade and supply chains lack elasticity.

We’ve learned (painfully) that flexibility is not a built-in feature.

Whether it’s PPE or PlayStations, shocks in consumer demand create bottlenecks.

Post-COVID-19 pandemic inflation wasn’t just a fiscal issue, it was rooted in these very bottlenecks.

As the Peterson Institute highlighted, demand market trends have surged in the last few years, fueled by price increases and product scarcity.

Strategic Planning for Shipping Container Users

For businesses that rely on modes of transport or global shipping container logistics, the moment to act is now.

Start by tracking container availability indices in China.

Monitor North America’s trucking demand for importers and exporters’ activity.

Recalibrate inventory thresholds and plan Q3 orders with lead times in mind.

When demand for shipping containers accelerates, so do all its associated costs.

If you’re in construction, retail, or manufacturing, it’s imperative to reassess your supply chain strategy now.

The Economics of the Surge in Shipping Container Demand

Let’s be clear: this isn’t just about transportation.

It’s about the economics of delay, scarcity, and opportunity cost.

If you’re late to the game, not only do you pay more, but you risk losing revenue and market share.

In a hyper-competitive landscape, being supply-ready is a differentiator.

Not All Containers Are Created Equal

There’s also a difference in container types.

Twenty-foot equivalent units, dry containers, refrigerated units, and high-cube containers each have unique supply patterns.

Knowing what your business requires and securing it early can be a game-changer.

Container leasing firms are already reporting increased inquiries.

Don’t be surprised if shipping containers for sale prices rise in the next two to three weeks.

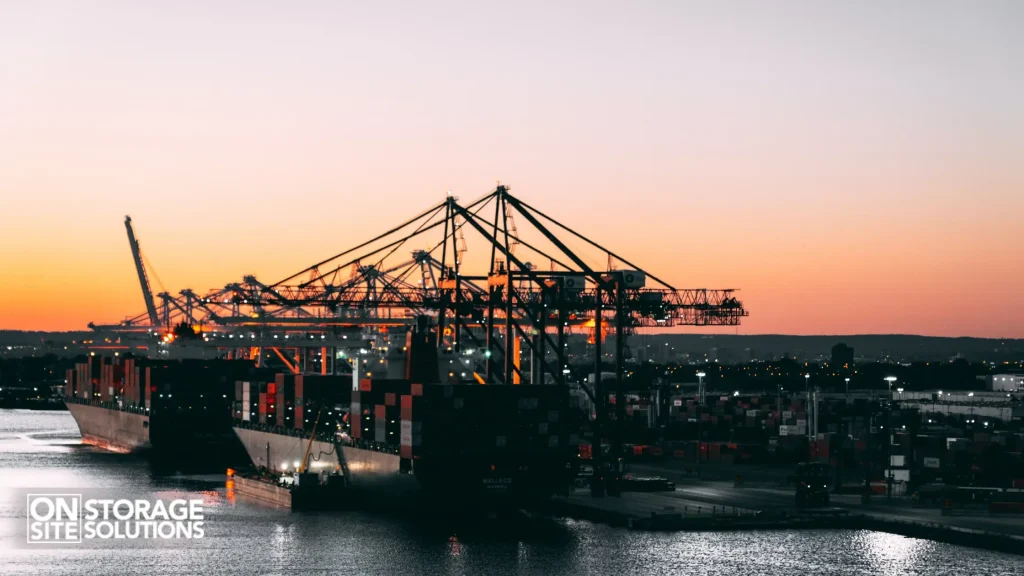

Why On-Site Storage Solutions Is Closely Monitoring the Shipping Container Demand

As a national provider of shipping containers for sale and rent, On-Site Storage Solutions is closely tracking these shipping container market developments.

We’ve seen firsthand how quickly market conditions shift.

During the pandemic, our container stock turned over at record speed.

Today, we’re preparing to scale our inventory and delivery network across key states.

If you’re looking to secure containers ahead of the surge, call On-Site Storage Solutions today at (888) 977-9085 to secure a container before the rush.

What Business Leaders Should Watch Next

In the coming weeks, pay close attention to:

- 90-day container booking lead times from China

- Freight rate indexes

- Port throughput reports

- Warehouse inventory turnover rates

If your business is built on imported goods, you cannot afford to be reactive.

Use this trade agreement as an inflection point.

The businesses that prepare now will be the ones that survive the next round of volatility.

Final Thoughts: From Bottleneck to Breakthrough

In a global economy defined by speed, reliability, and agility, nothing disrupts progress like a clogged pipeline.

Shipping container demand is not just a metric, it’s a signal.

And right now, that signal is flashing red.

So let’s heed that advice.

Get ahead of the demand shock.

Anticipate the change.

Adapt your logistics strategy.

And turn what could be a crisis into your biggest competitive advantage.